New Report: Amid Pandemic, Manufacturing Industry Pivots to Fulfill Needs for COVID-19 and Vaccine Rollout

Press Room Jan 14, 2021

This press release was issued on January 14, 2020 via Business Wire at 9:45 AM. The release can also be found on Supply Chain Quarterly, DC Velocity, Plant Services, Packaging Strategies, Flexible Packaging, and Supply Chain Quarterly.

New Report: Amid Pandemic, Manufacturing Industry Pivots to Fulfill Needs for COVID-19 and Vaccine Rollout

Cold chain services and supplies, surveillance equipment, printing services and biodegradable packing among growth sectors in 2021

New York (January 14, 2021) – Thomas, the leader in product sourcing, supplier selection, and marketing solutions for industry, today released its ‘2020 Q4 Top Manufacturing Trends,’ identifying the top products and services sourced by North American manufacturers, as well as sharing predictions for 2021 industrial sourcing trends.

The Q4 sourcing data report illustrates the continued reshaping of North American manufacturing, specifically how industry adapted to address urgent needs in the fight against COVID-19 and how sourcing in 2021 will be impacted by the ongoing pandemic and associated vaccine rollout.

“While this past year has brought unprecedented challenges, the manufacturing sector at large continues to be a resilient force as it adapts to overcome rising obstacles – from diversifying its supply chain to combating the skills gap,” said Thomas President and CEO Tony Uphoff. “Our unique data exemplifies how industry has pivoted to adjust to the COVID-19 pandemic as states and businesses forge ahead to implement safe and effective reopenings.”

The complete Q4 Sourcing eBook, which is now available for download, includes all 20 categories which saw the biggest YoY increase in sourcing, outcomes from Q4 industrial sourcing activity, and the latest predictions regarding 2021 sourcing trends. A brief snapshot includes:

Top 5 2020 Q4 Manufacturing Trends:

|

TOP 5 Products in Q4 1. Face Masks 2. Nitrile Gloves 3. Hand Sanitizers 4. Lumber 5. Pumps |

TOP 5 Services in Q4 1. CNC Machining 2. Plastic Injection Molding Services 3. Screen Printing 4. Metal Fabrication 5. Commercial Printing Services |

TOP 5 Products and Services Sourced YoY (2019/2020) 1. Face Masks: 38,238% 2. Hand Sanitizers: 11,568% 3. Nitrile Gloves: 3,619% 4. Disinfectants: 2,576% 5. Decals: 1,887%. |

2021 Q1 Predictions: Top 5 2020 Q4 Manufacturing Trends:

COVID-19 Vaccine-related Supplies and Equipment: 30-33% Projected Increase

As COVID-19 vaccine manufacturers like Moderna and Pfizer race through a carefully orchestrated logistics process to distribute their critical vaccines worldwide, Thomas anticipates a steady increase of industrial sourcing in categories essential to this endeavor over the next quarter. These categories include dry ice, ultra-low temperature freezers, and cold storage services.

Security and Surveillance Equipment: 15-18% Projected Increase

With numerous B2B and B2C businesses nationwide closed because of COVID-19-related restrictions, Thomas expects industrial sourcing for security and surveillance related equipment, including security cameras, surveillance systems, and surveillance cameras, to increase over the next three months as business owners look for additional ways to protect their businesses and safeguard their properties during closures.

Printing Services: 12-15% Projected Increase

As demand increases for businesses nationwide in light of residual COVID-19 impacts, industrial printing businesses specializing in various services, including screen printing, digital printing, and commercial printing, will see an uptick in sourcing.

Biodegradable Packaging and Biodegradable Bags: 7-10% Projected Increase

Our Thomasnet.com® data shows that sourcing activity in 2019 and 2020 reflected substantially increased interest in sustainability. We anticipate that this trend will continue into 2021 with a specific focus on biodegradable packaging and bags, with both categories increasing over the course of Q1.

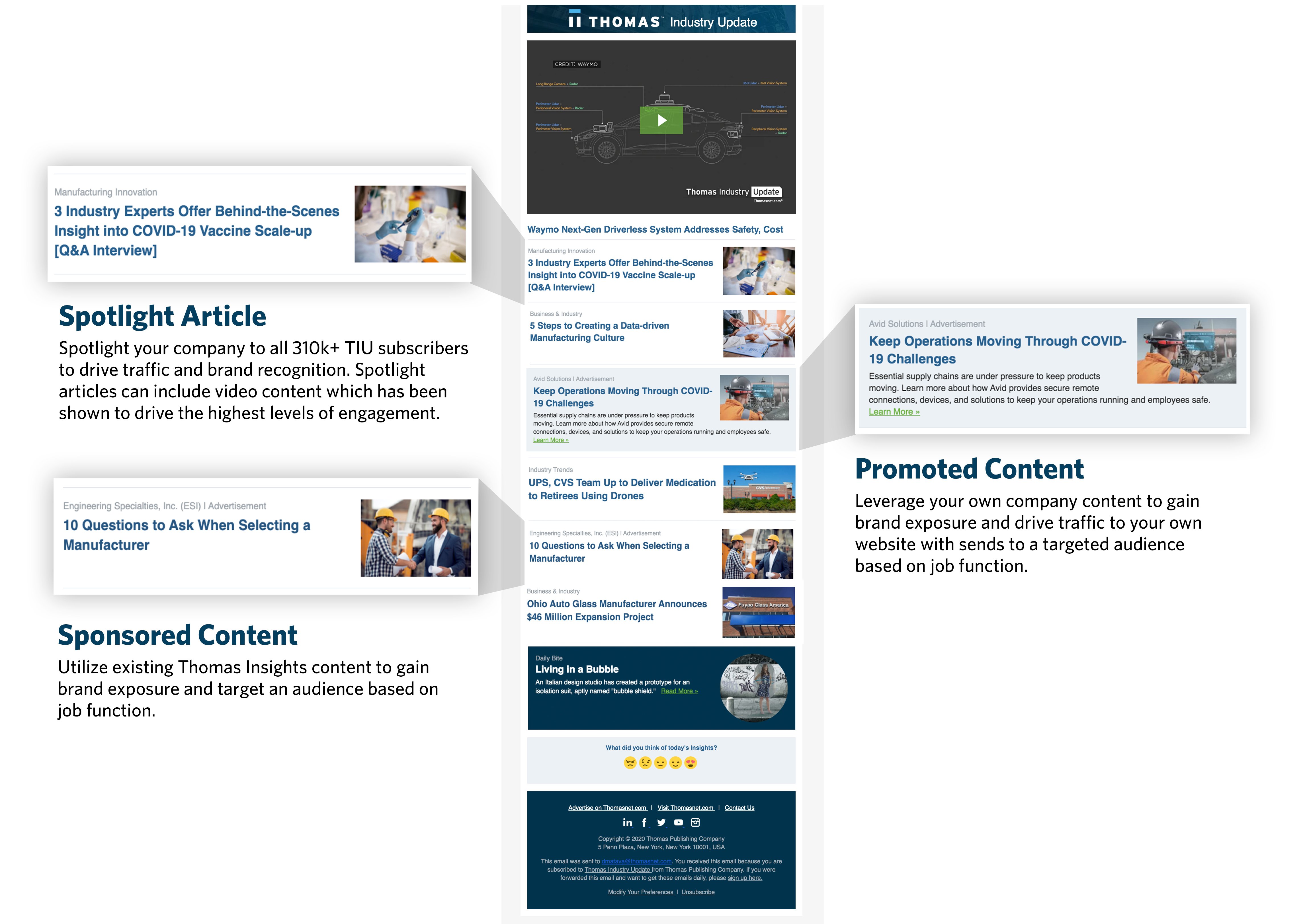

“At Thomas, we continue to work diligently to provide solutions to better guide industry as it adapts to and navigates new challenges. We encourage businesses to leverage our resources like the daily Thomas Industry Update newsletter and biweekly Thomas Industry Update Podcast, which provide data that can help inform business leaders in making sound business decisions,” added Uphoff.

The platform Thomasnet.com serves 1.18 million active registered users and 14 million industrial professionals who access information for their procurement and marketing needs.

Download the Q4 Sourcing eBook and see the full list.

About Thomas

Thomas provides actionable information, data, analysis, and tools that align with and support today's industrial buying process. Its solutions include the Thomas Network at Thomasnet.com®, industry's largest and most active buyer/supplier network. Through Thomas Marketing Services, the company provides full-service industrial marketing programs and website development. Thomas Product Data Solutions helps manufacturers connect with design engineers through advanced CAD/BIM and data syndication services. Thomas Industrial Data supplies sourcing and supply chain trend data to media, investors, analysts, and researchers to provide market insight and inform decision making. Thomas WebTrax® provides opportunity intelligence on in-market buyers to help marketing and sales teams track, identify and engage high-value prospects. Thomas Insights delivers original content to help marketers and supply chain professionals inform their decision-making, through leading titles including Inbound Logistics®, Thomas Industry Update, Industrial Equipment News® (IEN®), and the Thomas Index™.

Contacts:

Media - Alex Kofsky - alex@rosengrouppr.com

Rita Lieberman - rlieberman@thomasnet.com

Did you find this useful?