NEW SURVEY: Still Under-Utilized, Apprenticeship Programs Prove Their Worth Amid COVID-19 Skill Shortages

Press Room Jul 15, 2020

This press release was issued on July 15, 2020

NEW SURVEY: Still Under-Utilized, Apprenticeship Programs Prove Their Worth Amid COVID-19 Skill Shortages

Latest Installment of North American Manufacturing COVID-19 Survey Series shows 38% of Surveyed Companies are Hiring

New York, N.Y. - July 15, 2020 – Thomas, the leader in product sourcing, supplier selection, and marketing solutions for industry, today released the results of its latest survey canvassing North American manufacturing and industrial sectors. This installment in the Thomas Industrial Survey Series generated insights from 746 North American manufacturing and industrial suppliers to identify the major trends stemming from the global pandemic as the industrial sector pivots its supply chains and tactics to prepare for the new industrial landscape.

A key survey finding shows the value of apprenticeship programs in combating the skills gap – 26% of companies surveyed have adopted such programs and industries that have done so were overall less impacted by the lack of available skilled labor.

The survey also indicated that while 91% of manufacturers are confident the industry will recover, many predict it will take months to several years to earn back the lost revenue.

"Manufacturing and industrial companies continue to demonstrate remarkable innovation and resilience to overcome the challenges brought on by COVID-19. Our latest survey shows interest in reshoring acceleration”, said Thomas President and CEO Tony Uphoff. “As companies work to adapt and implement the most impactful practices to support the industrial economy, the survey also shows expanding interest in automation, pivoting supply chains, and addressing the labor shortage. Clearly North American manufacturing is strategically adapting to this new era of industry.”

Additional key findings include:

- The Impact and Future of Automation: Over half of the respondents feel that they meet or exceed industry standards on automation processes. The top three automation technologies that manufacturers are most interested to invest in over the next 12 months are production performance (55%), product testing & quality assurance (48%), and process control (46%). Findings also reveal that in the wake of COVID-19, many companies have turned to AR to avoid sending technicians to customers in affected areas, and that automation has helped speed up the time it takes to finish products.

- Reshoring and Domestic Sourcing Trends: 69% of respondents report that they are extremely likely to bring production/sourcing back to North America in the future, with Agricultural, Energy/Utilities, and Food & Beverage sectors leading in interest. Additionally, the top products North American manufacturers are looking to source domestically include metals (15%), machining tools and parts (13%), fabricated materials (13%), and personal protective equipment (12%).

- Future of Work and Skilled Labor: More than one in three companies report they are actively hiring. Additionally, while 52% of companies have continued their apprenticeship programs during the pandemic, 40% report they have paused their programs in place and only 3% have ended it. Additional sentiment from the survey includes that reshoring will ultimately lead to an increase in high paying jobs, growing demand for skilled jobs, and the need for an exponential number of support jobs.

METHODOLOGY

The study was conducted online using Qualtrics. Participating suppliers are mostly OEMs and custom manufacturers from a variety of industrial sectors with revenues spanning from less than $4.9 million to over $500 million. The Thomas Industrial Survey series was initially launched in February 2020 as a response to the COVID-19 outbreak and garnered a total of 4,653 respondents with 3,452 qualified responses. Click here to get a copy of the Thomas Industrial Survey report.

About Thomas' COVID-19 Response

Thomas has launched a three-part COVID-19 Response in light of the global pandemic. First, the Thomas COVID-19 Resource Hub provides mission-critical, real-time information and important updates to keep industrial business leaders up to date. Second, a new industrial sourcing filter on Thomasnet.com identifies suppliers with readily available products and service capabilities as COVID-19 Response Suppliers; over 2,500 suppliers are now included in this group. Finally, Thomas is facilitating partnerships between manufacturing companies to keep industrial businesses moving forward during this time.

About Thomas

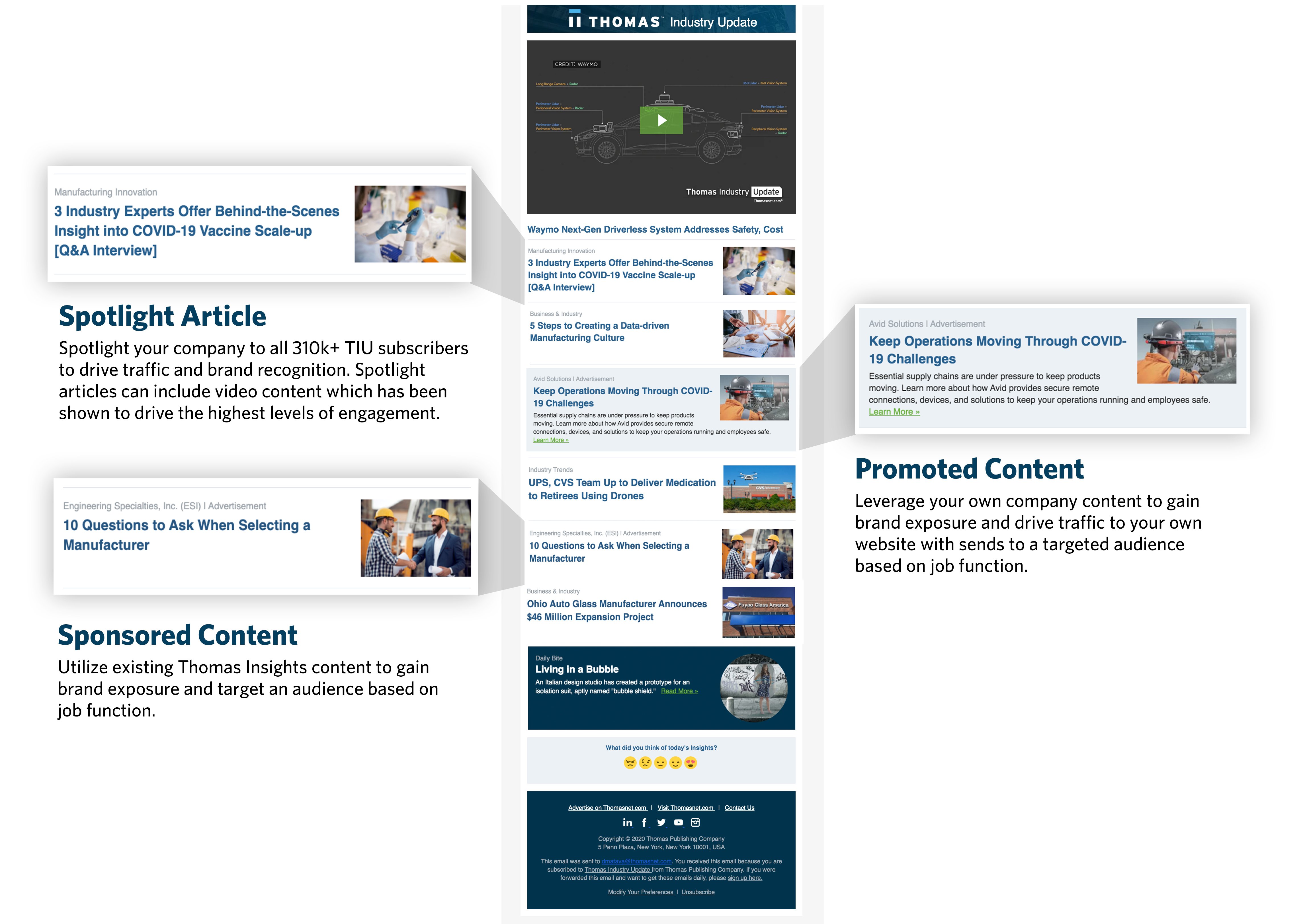

Thomas provides actionable information, data, analysis, and tools that align with and support today's industrial buying process. Its solutions include the Thomas Network at Thomasnet.com®, industry's largest and most active buyer/supplier network. Through Thomas Marketing Services, the company provides full-service industrial marketing programs and website development. Thomas Product Data Solutions helps manufacturers connect with design engineers through advanced CAD/BIM and data syndication services. Thomas Industrial Data supplies sourcing and supply chain trend data to media, investors, analysts, and researchers to provide market insight and inform decision making. Thomas WebTrax® provides opportunity intelligence on in-market buyers to help marketing and sales teams track, identify and engage high-value prospects. Thomas Insights delivers original content to help marketers and supply chain professionals inform their decision-making, through leading titles including Inbound Logistics®, Thomas Industry Update, Industrial Equipment News® (IEN®), and the Thomas Index™.

Contacts:

Media

Alex Kofsky

Rita Lieberman

rlieberman@thomasnet.com

Did you find this useful?